what is tax planning explain its importance

Heres a quick rundown of some of the benefits that a good tax payment plan holds. Start filing for free online now.

Differences Between Tax Evasion Tax Avoidance And Tax Planning

To reduce tax liability.

. Ad Save time and increase accuracy over manual or disparate tax compliance systems. Tax Planning can be understood as the activity undertaken by the assessee to reduce the tax liability by making optimum use of all permissible allowances. Tax Planning involves planning in order to avail all exemptions deductions and rebates provided in Act.

Each year the tax law becomes more and more complex and with that complexity comes more opportunities to potentially reduce your tax liability arise. Too often people wait until the very last second to try to use a tax benefit. Tax Planning Gives You Time to Strategize and Get the Most Out of Your Benefits.

It is a process of finding an optimal level of investment risk. Financial Planning is process of framing objectives policies procedures programmes and budgets regarding the financial activities of a concern. Tax Planning is an activity conducted by the tax payer to reduce the tax liable upon himher by making maximum use of all available deductions allowances exclusions etc.

Over 85 million taxes filed with TaxAct. Long range and Short range tax planning. Taxes are generally an involuntary fee levied on individuals or corporations that is enforced by a government entity whether local regional or national in order to finance.

The prime objectives of tax planning are. It essentially includes generating a financial blueprint for. Hence the objective of tax planning cannot be regarded as offending any concept of.

Always plan your taxes before you plan to invest. Financial Planning includes all the activities which are related to the. Since tax planning includes investment mechanisms designed to reduce your tax liability it is important that you do risk profiling.

Tax Planning can be understood as the activity undertaken by the assessee to reduce the tax liability by making optimum use of all permissible allowances deductions. Compliance regarding tax payment reduces legal hassles. Financial planning is the plan needed for estimating the fund requirements of a business and determining the sources for the same.

Taxes are levied in almost every country of the world primarily to raise revenue for government. Answer 1 of 7. Tax planning facilitates the smooth functioning of the financial planning process.

Over the long term this helps your business achieve its financial goals more easily. Objectives of tax planning. Ad Import tax data online in no time with our easy to use simple tax software.

Every taxpayer wishes to retain a maximum part of the earnings rather than parting with it and facing. Family members have duked it out in court for years and things can often get ugly. This ensures effective and adequate.

Take the burden of sales tax compliance off your plate with help from Avalara AvaTax. The objective of tax planning is to make sure there is tax efficiency. One of the things tax planning does is identifying the tax bracket you fall.

Tax Planning allows a taxpayer to make the best use of the different tax exemptions deductions and. Financial Planning is one of the major planning that is required to be conducted by the management. I Reduction of tax liability.

Planning is the outcome of a mental process rather than wishful thinking and guesswork. It is based on. Meaning Of Tax Planning.

Taxation imposition of compulsory levies on individuals or entities by governments. The Income Tax law itself provides for various. First-time taxpayers must understand the fundamental objectives of planning their taxes.

There are various methods of tax planning you can use. Tax rates are constantly. Planning is a thinking process and it is separate from organisational activities.

They are as under. Here are the key advantages of tax planning. What is tax planning explain its importance.

Tax planning is the logical analysis of a financial position from a tax perspective. By having an estate plan to designate who inherits what you and your family members can. Tax planning is the process of analysing a financial plan or a situation from a tax perspective.

Why It Matters In Paying Taxes Doing Business World Bank Group

What Is Tax Planning Definition Objectives And Types Business Jargons

Importance Of Tax Planning For Corporates And Individuals

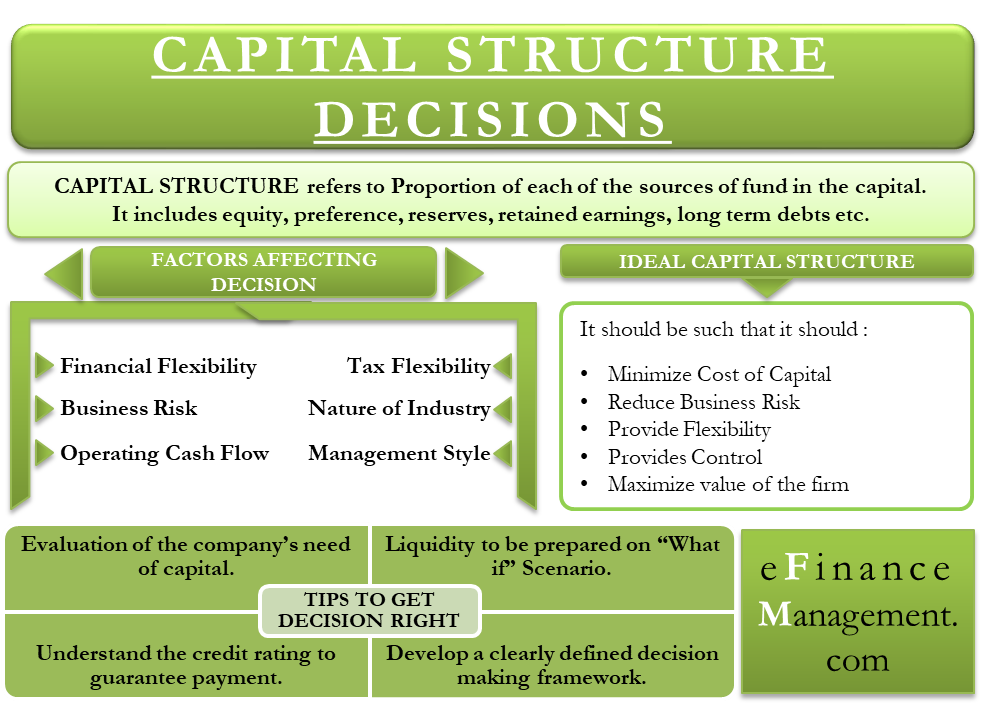

Capital Structure Decisions Importance Factors Tips And More

7 Strategies To Save You Thousands Each Year In Taxes Year End Tax Planning Business Tax Small Business Tax Small Business Bookkeeping

6 Steps To Write A Comprehensive Financial Plan For Your Small Business

Differences Between Tax Evasion Tax Avoidance And Tax Planning

The Objectives And Importance Of Financial Planning For An Organization

What Is Financial Planning Types Meaning Objective Importance Faqs

Tax Planning In India With Types Objectives

Explain Need Or Importance Of Location Planning

Planning And Decision Making Characteristics Importance Elements Limitations Studiousguy

Planning And Decision Making Characteristics Importance Elements Limitations Studiousguy

What Is Tax Planning Definition Objectives And Types Business Jargons

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Filing Of Audited Or Un Audited Accounts As Well As Tax Planning Is Very Important The Inland Revenue A Filing Taxes Tax Filing Deadline Financial Statement

Differences Between Tax Evasion Tax Avoidance And Tax Planning